In today's competitive real estate market, maximizing revenue and occupancy requires strategic property positioning based on deep understanding of target demographics, local trends, and unique selling points. Developers create compelling value propositions by identifying specific audiences and catering to their needs through architectural design and community amenities. Staying ahead of market shifts ensures properties remain desirable, driving up rental rates and boosting revenue for owners and investors. Comprehensive market analysis, niche opportunity identification, and proactive trend monitoring are key strategies for success in real estate.

In today’s competitive real estate market, maximizing building revenue and occupancy is a constant challenge. This article guides property managers and investors through strategic approaches to boost profitability. We explore crucial aspects such as strategic property positioning, leveraging market trends, and efficient operations. Additionally, we delve into innovative marketing techniques, highlighting the power of digital storytelling and online visibility. By implementing these strategies, real estate professionals can navigate the landscape effectively, attracting tenants and buyers while ensuring long-term success.

Strategic Property Positioning for Higher Revenue

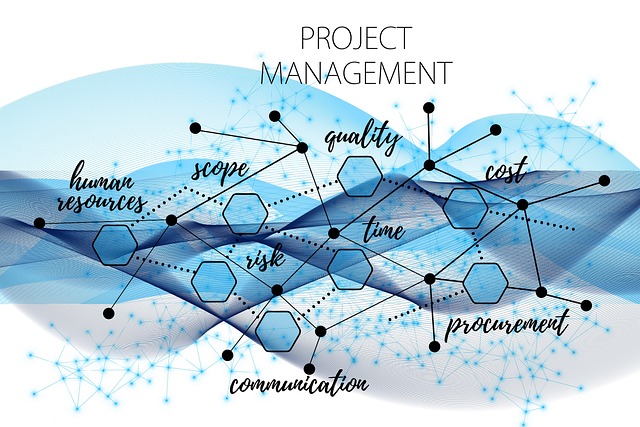

In the competitive real estate market, strategic property positioning is key to maximizing revenue and occupancy rates. It involves a nuanced understanding of target demographics, local trends, and unique selling points. By identifying a property’s ideal audience—be it young professionals, families, or retirees—and tailoring its offerings accordingly, developers and investors can create a compelling value proposition. This might include architectural design elements that appeal to specific lifestyles or community amenities that cater to particular needs.

A well-positioned property doesn’t just attract tenants; it fosters a sense of belonging and longevity. Real estate experts achieve this by staying ahead of market shifts, anticipating future demands, and incorporating innovative features that stand out in a crowded marketplace. This strategic approach ensures properties remain desirable, driving up rental rates and occupancy levels over time, ultimately boosting revenue for both owners and investors.

– Market analysis and identifying niche opportunities

In the competitive real estate market, conducting a thorough market analysis is key to unlocking maximum revenue and occupancy potential. By delving into demographic trends, local regulations, and industry insights, developers can identify niche opportunities that might be overlooked by competitors. This strategic approach involves understanding target audiences’ needs and preferences, allowing for the creation of specialized properties tailored to specific markets. For instance, focusing on sustainable and smart home features could cater to environmentally conscious buyers or tenants, commanding premium prices in the right locations.

Identifying these niche opportunities requires a close eye on emerging trends and adapting to changing consumer demands. Real estate professionals can stay ahead by analyzing data from similar projects, studying market gaps, and staying informed about local development plans. This proactive approach ensures that investments are well-positioned to capture high demand, resulting in increased occupancy rates and attractive rental or sales prices.

– The role of location in maximizing occupancy and revenue

In real estate, location is paramount for maximizing both occupancy and revenue. The right neighborhood or area can attract tenants and buyers seeking specific amenities, schools, transportation routes, or lifestyle preferences, thereby increasing property demand. For instance, properties located in vibrant urban centers or close to emerging tech hubs often command premium prices due to high desirability. Conversely, underutilized areas with untapped potential can be transformed into lucrative opportunities by strategic repositioning and marketing.

A key aspect of location-driven success involves understanding demographic trends and consumer behaviors. For commercial real estate, identifying industries in growth or decline helps investors make informed decisions. For residential properties, knowing the family-friendly zones, retirement hotspots, or areas popular among young professionals allows developers to cater their offerings accordingly. Leveraging data analytics and market research ensures that buildings are strategically positioned to capture maximum occupancy and generate sustainable revenue streams.